How to Prepare for Rainy (Financial) Days

The best time to start preparing for financial rainy days is while the sun is still shining. Many people use the good periods in their financial history to invest or to make the purchases they have always dreamed of. Preparing for a rough time usually gets overlooked or postponed.

It’s a mistake to do so, especially because making preparations isn’t that hard and it doesn’t have to make your day-to-day financial situation any less comfortable. It usually takes just a bit of effort and planning to put aside a significant amount to your savings account.

Keep track of the spending

The first thing to do in order to get your spending in order is to keep close track of it. Once this is done for a month or two, you’ll have enough data to find patterns in your spending and adapt it where it’s needed.

There are apps to help you with the process. The only thing to do is to be honest with yourself and to input every expense you have and all the money you got coming in. Most of it can be automated if you’re using a card or an online payment method.

Have a plan

Most financial problems arise because there’s no clear plan to what you want to accomplish with your money. That leads to both overspending and not investing at the right time. It’s best to write out and review a plan at least every six months.

The plan should underline what your main goals are for the months to come and it should have a portion devoted to savings and to investing. It should also calculate your regular expenses, such as tax payments and other transactions that happen on a fixed term basis. It becomes very important to ensure that you file your taxes on time and ensure that there aren’t any payments leftover (which can turn into back taxes – click to investigate further).

Once all of these expenses have been taken into account, you can easily create a plan for the rest of your funds. This will allow you to make long-term plans and avoid being surprised by the changes in the market.

Additional income

One of the ways of preparing for rainy days is to make sure your revenue streams are diversified and you have something to fall back on, in case something goes wrong with your main job. This doesn’t mean you should have two jobs at once and push yourself beyond your limits.

Additional part-time gigs like taking paid surveys should be something you can do on your own time and it shouldn’t require you to invest in additional infrastructure. These jobs can easily become long-term careers if there’s a need for it.

Automate the savings

Modern technology can be of great assistance when it comes to savings. It can help you automate your savings and save you the trouble of deciding how much to put aside every month. This also means that you won’t be able to give up on your savings plan, at least not as easy as you otherwise would.

It’s also useful to use a separate bank account for this purpose alone. It will also make it more difficult for you to dip into the savings every now and then, which is how most saving plans fail.

How much should you save?

This is probably the most important question regarding emergency fund preparation, but there’s no one answer that can be applied to every household. It depends on how old you are, how much money you make and what kind of long-term expenses you need to plan for (for instance, those with kids should take their education into consideration).

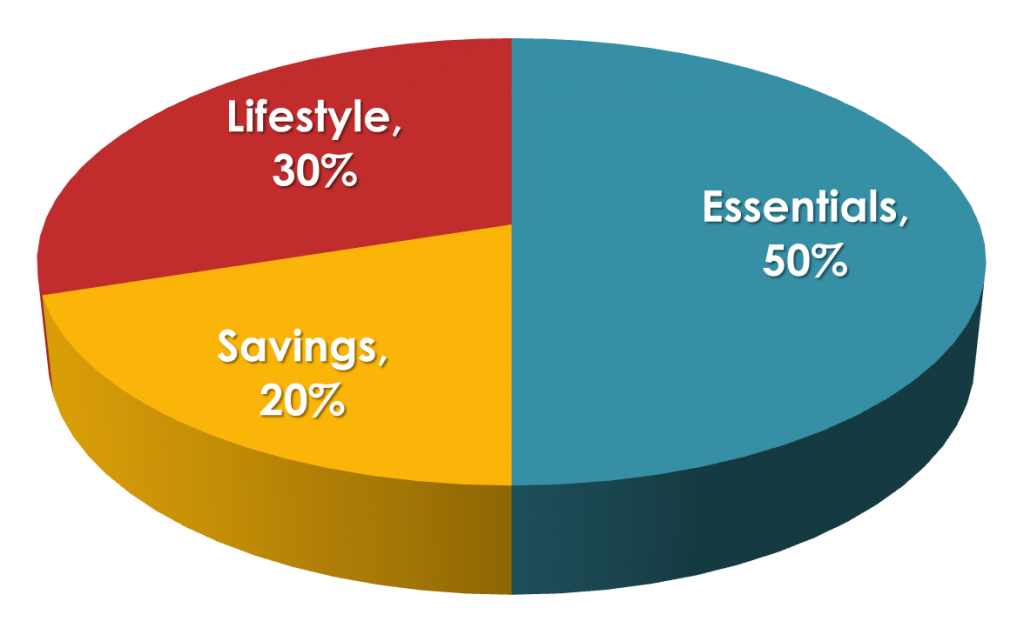

The unwritten rule is that 50 percent of your income should go to necessities and 30 percent should be devoted to discretionary spending. The remaining 20 percent should be left aside for savings and emergency funds.

When things get difficult

Organizing, planning, and preparing are one part of the issue, but actually dealing with a financial problem is something completely different. It always involves more stress, more difficult decisions and discomfort that you might have imagined. The important thing is not to panic, but to approach the problem with a clear plan.

Even when you have savings dedicated to this situation in particular, it’s important to adapt your habits to the new reality. Make a list of expenses and organize them based on importance. Try to cut back on things that aren’t essential until you get back on your feet.

Everyone experiences financial troubles every now and then. By being responsible with your money and saving a small amount every month, you can prepare for them and make them far less uncomfortable.

- Top 20 most sought-after vacancies - November 8, 2022

- How to Design an Office for Improved Productivity - April 6, 2022

- Franklin Engineering: Diesel Engine Reconditioners Guide for Business Vehicles - April 6, 2022